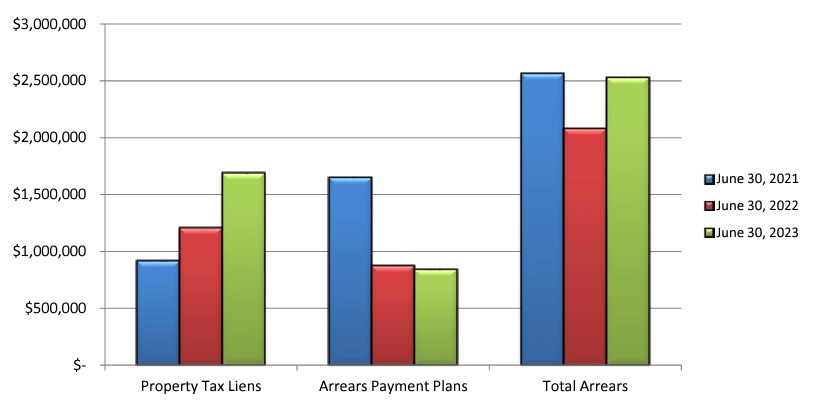

Total tax arrears owed during 2023’s second quarter increased by nearly $450,000 from 2022, while the amount of money from repayment plans continued to decline — evidence of how much residents are struggling financially.

City administration presented the second-quarter financial report during the Aug. 28 regular city council meeting. Data about tax arrears and outstanding debt were contained within the document.

Council voted unanimously to receive and file the report.

Property tax arrears

As of June 30, taxpayers owed $2,529,801 in total arrears, which included $1,688,722 in property tax liens and $841,079 in payment plans, the report said.

Conversely, as of June 30, 2022, taxpayers owed $2,080,157 in total arrears, which included $1,205,881 in property tax liens and $874,276 in payment plans.

Therefore, the total outstanding amount of tax arrears increased by $449,644 from Q2 2022 to Q2 2023. This comprised a year-over-year increase in liens of $482,841 and a year-over-year decrease in payment plans of $33,197.

Meanwhile, by June 30, 2021, taxpayers owed $2,564,950 in total arrears. This included $915,748 in property tax liens and $1,649,202 in arrears payment plans.

“Tax arrears are up somewhat (in Q2). Probably a number of things riding that,” said finance director Brian Acker. “One is just economic circumstances of people being able to afford to pay their taxes, with inflation and all the other cost pressures they’re seeing.

“The other is, during the implantation of our new tax system, we did not do as much tax enforcement as we normally would; we directed our resources to the new system,” he added. “So that likely has some impact.”

Coun. Crystal Froese expressed concern about how tax arrears were jump up again, similar to how the pandemic affected residents in 2021. It concerned her to see people struggling again with their finances.

“It’s just something we need to be aware of here in our city, that everyone is feeling the pinch as we see those numbers creep back up again,” she said.

Property taxes receivable

Property taxes receivable consists of tax arrears and taxes owing. Tax arrears are overdue taxes, while current taxes are due but have not fallen into arrears. Taxes fall into arrears in the next year following the levy of taxes.

The total outstanding property taxes receivable as of June 30 was $2,529,801 — all of which were arrears since there were no current outstanding taxes, according to the report.

In comparison, total property taxes receivable that were outstanding by the end of Q2 2022 was $16,534,844, followed by $30,172,095 in 2021, $27,432,046 in 2020, $15,597,758 in 2019 and $13,714,702 in 2018.

Borrowing/debt

As of June 30, there were seven projects that city hall was still repaying — or guaranteeing — after borrowing money to finance them.

The principal outstanding amount on each project was:

- Multiplex/Events Centre long-term loan: $11,676,000

- Sanitary sewer long-term loan: $0

- Waterworks capital long-term loan: $22,328,000

- High-service pumphouse: $7,451,000

- Buffalo Pound Water Treatment Corporation loan term loan (Bank of Montreal): $8,908,062.05

- Buffalo Pound Water Treatment Corporation loan term loan (TD Bank): $14,734,274.36

- Moose Jaw Municipal Airport Guarantee: $1 million

These seven projects total $66,097,336.41, a decrease from $68,363,379.22 at the end of Q1; the debt limit is $95 million.

Meanwhile, the municipality is committed to a Buffalo Pound Water Treatment Corporation loan term loan of $14,300,000 in 2024. That amount will appear on the books that year.

The next regular council meeting is Monday, Sept. 11.

In response to some providers blocking access to Canadian news on their platforms, our website, MooseJawToday.com will continue to be your source for hyper-local Moose Jaw news. Bookmark MooseJawToday.com and sign up for our free online newsletter to read the latest local developments.